If you’re here, I’m assuming you’ve got student loan debt. Welcome. And I’m sorry. We’ll get through this together.

If you’re here, you may or may not be a writer already. Either way, I’m here to help. Whether you’re a writer looking to pay off a debt or a former student desperately Googling for advice, let me show you how a writing habit will help you pay off your debt.

Why You Need This Advice

Paying off student debt is about a few different things. It’s about having SOME money, it’s about being somewhat financially aware. But more than anything, it’s about changing your mindset. I know that sounds really stupid, and I wouldn’t believe that kind of nonsense coming from me either. Let’s start off with some advice from people who know what they hell they’re talking about.

The most dangerous debt you can ever have is student loan debt because student loan debt is not dischargeable in bankruptcy. So I want you to change your attitude — stop feeling like you're drowning in student loan debt and start feeling like you're swimming in the future of your life...and that your student loan debt allowed you to get there. Change your attitude and you'll see your financial life change, too.

Yeah, like she said. Take a swim in Lake You.

Dave Ramsey’s method for paying down debts, as he says,

...is about behavior modification, not math.

Two financial gurus, both saying the same thing: paying off debt isn’t about waiting for a rich uncle to die and leave you money provided you stay in his haunted house. Which, by the way, I advise you do should the situation arise. If the house was really haunted, he would want you to stay there BEFORE he died so he could watch ghosts scare the bejeezus out of you. Therefore, if you get this offer, assume the house isn’t really haunted or that your uncle isn’t really dead. This is all common sense and what I assume people mean when they use the phrase “financial literacy.”

Anyway, the experts agree. Paying off debt is all about changing the way you think about money. Easier said than done.

While the Ormans and the Ramseys of the world can tell you to change your mindset, they are a little quieter about how to do it. Which is where I come in.

Writing gave me the tools to change the way I think about money, and those tools helped me pay off my student loans. Yes, you’re hearing from a debt free man right now.

It’s kind of awesome. I’ve never really impressed anyone with physical ability, handsomeness, morality, intelligence…

I’ve never really impressed anyone, but when I paid off my loans, I became this rare, admirable creature. Like a centaur. A slightly richer centaur.

Narrative-ize Your Debt

The biggest problem when the piper came a-pipin’ and it was time to start paying off my student loans was that the amount I owed was staggering. It wasn’t even a real number. There was no way in hell I’d ever pay it off, so why even try? Why put in one cent more than I absolutely had to as required by my income-based repayment plan? (By the way, if you want to take a blow to your self-esteem, apply for income-based student loan repayment. Ouch.)

I had to make the number real. I had to make it seem like putting money towards my loan mattered. I had to change my mind, and what I did was draw on some storytelling skills. After all, we’re all a lot better at doing something when there’s a good story involved.

I decided to write out a story for myself.

In this story, my loan was given to me through a time portal by Hitler. And Hitler was funding the war effort off my interest. Now, obviously he wasn’t winning the war with my cash, but every cent I could rob him of, that was one less Nazi bullet.

There’s more to the story. As it usually goes with Nazis. There was a giant mechanical war machine that needed some sprockets or something, a mystical power from realms beyond our own. That kind of Hellboy nonsense.

As stupid as it sounds, imagining my loan in this weird scenario helped. Really! It made paying back my loan feel like something important. Something that mattered to more people than just me.

I’m not saying you have to make up a time-loan Hitler story for your loans. What I’m saying is, build your own debt narrative. You can make it some kind of Dungeons & Dragons nonsense, a Star Trek thing. You can ground it in reality and think of how much you'd like to be donating that cash to your favorite charity. Make it whatever works for you, but whatever you do, don’t skip this step. Really do it. Write it out for yourself. Be detailed. You need to change the way you’re thinking about your student loan debt, and this will get you started.

Writing Is The Ultimate Cheap Pastime

When I think of cheap hobbies, I think of fishing first. Just a couple kids by a river, cheap poles, ritualistically goring worms and drowning them. Wholesome fun.

Then I start thinking about the aisles and aisles of fishing stuff at your average Wal-Mart. And let me tell you, I was disturbed to discover, on a recent flight, that the giant pyramid in downtown Memphis, visible from the air, was a Bass Pro Shop. I’m not kidding.

Somehow, someone is making enough money off of fishing to fund a goddamn pyramid.

Even something deceptively cheap, like jogging, can get expensive. Shoes, gym membership for the winter, clothes that look really cool until you’re outside and realize that reflectors are cool in theory and not cool on your body.

There’s no hidden cost to writing. I don’t think you could support an entire pyramid through sales of writing stuff. Because there just isn’t that much to buy, and because many writers actively discourage spending a lot of cash. You’re a lot more likely to come across writers using completely outdated technology or purposely downgrading their high tech stuff than you are to find someone buying the latest and greatest.

Writing truly is a cheap pastime. There’s very little to buy, and within writing circles it's known that buying pricey writing stuff is for chumps. You're not only signing up for something that's cheap, but there is no reward within the social group for spending a lot of money.

Writing Is A Good Time Killer

When you’re trying to pay off debt, gobs and gobs of free time are your enemy. Think about it: what do you do in your free time? Shop? Shop online? Hit up a concert? Go out and drink? Eat out? Catch a movie? Play a video game? All this stuff, it’s spending money to kill time. That’s not helpful. That’s exactly what you have to stop doing.

Writing is killing time to SAVE money. Writing takes FOREVER, and it eats up huge chunks of time where you can’t multi-task. Can you Netflix and shop? I would hope so. Can you write and shop? Not really. They’re separate. Goodness knows I’m dying to finish writing this column so I can switch over to Amazon and buy a couple different portable urinals. I don’t want to talk about why. Which makes it seem like I should have left out that detail.

Write a lot, kill a lot of time, save a lot of money, get out of debt.

You Can Make A Few Bucks

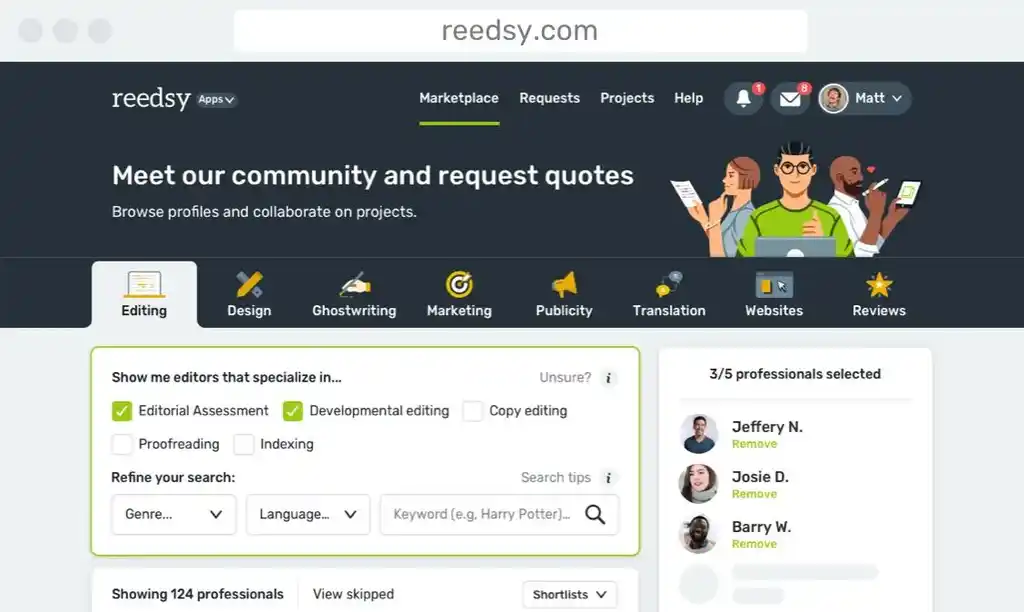

You’re not going to pay off your student loans by writing a book and getting it published. Even if you do get a book published, when you look at the hourly, you’re much better off working at Arby’s (plus, all the Horsey Sauce you can chug). But what you CAN do is make writing your side hustle.

For those unfamiliar, a brief explanation of the side hustle: a side hustle is a job you take on, separate from your 9-5, for a little extra cash. The hallmarks of a good side hustle are that it allows you to set your own schedule, allows you to take on as little or as much work as you can handle, and that you’re doing something that wouldn’t support you completely but makes for a nice little bonus.

While we’re at it, the hallmarks of a bad side hustle are that they’re Mary Kay, LuLaRoe, or anything that involves you throwing a “party” and forcing your friends to buy stuff.

Writing is a great side hustle as long as you’ve got reasonable expectations about what you’ll earn. If you can make $25/month writing, set a lowish goal like that, it makes a huge difference. I know it doesn’t sound like a lot, but over time it makes a huge dent in your student loans.

We weren’t going to get out of this without doing some math. Sigh.

Put in $25 bucks every month. Times 12 ends up being $300/year. Which, over the normal, 10-year repayment period, is $3,000. Put it all together and you’ve finished off your loan a year earlier than you otherwise would have. All because of an extra $25 you made on a side hustle.

The real beauty of the income from a writing side hustle is that it’s extra, earned cash. It’s not a huge windfall. It’s a little bit of something, which can be more helpful when it comes to paying off debt. It’s tough to get a $1,000 bucks and put it all towards your student loan. It’s pretty easy to throw $25 bucks that way.

Remember, it’s about changing your mindset so you see the value of kicking in those little extra bits of cash. Generate the cash, put it into your loan, and give it some time.

You'll Learn To Love The Slow Drip

Loan payments feel like drops in the bucket. And they are. And not only is the bucket huge, it’s increasing in size at a monthly rate of 6.8%. And you get constant letters and emails reminding you of this bucket. Lousy, stupid bucket.

You need to get used to the idea of putting a lot of work into something for a small, almost unnoticeable result.

Writing will get you used to that. It’s a habit that involves lots of small input over an extended time period. Editing a manuscript feels like an impossible task. But you get yourself into the mindset of doing a little every day and watching something build.

This is why writing and a writing mindset will help. Writing speaks directly to the most difficult part of paying off loans, which is getting used to the idea that this is the long, long, interminably long game, and it won’t feel like you’re making progress most of the time.

Start writing, get yourself used to the long game, and apply that same mindset to your loans.

Other Concrete Advice

Okay, okay. You started writing, and you’ve changed your mind about the way money works. Congratulations, you!

But maybe you’d like a couple other pieces of advice that’ll help you pay down your loan a little faster. I have two of them.

Online Spending

Whatever I spent online, I had to put that same amount into my loans. That’s it.

So, if I bought a quick, $1.99 Kindle book, I had to log into my student loan account and kick a couple bucks in there. If I bought concert tickets online, I had to put the same amount into my loan.

This was most painful during the holidays because I bought a lot of my gifts online, and I had to throw money into my loans even though the shit I was buying wasn’t for me. Seemed like a scam. Which it was. A scam to trick myself out of my own money.

It works because it’s a double-whammy. You not only put the money into your loan, but you start making better spending decisions when everything costs twice as much. “Do I really want to buy these concert tickets if they’re $80 apiece thanks to the system I’ve set up for myself?”

Get A Round-Up Going

I use an app that takes what I spend on a debit card, rounds it up to the next whole dollar, and then invests it. I haven’t made a damn thing from the investments, but rounding up is awesome. It’s a way to trick yourself into saving, the modern day equivalent of a change jar. You can probably do this through your bank, or you can go the route I did. I recommend investing because it’s fun to check your phone and act like you’re being all important when you really have almost no idea what’s going on and therefore couldn’t be certain if Bane’s attack on Gotham’s stock market in Dark Knight Rises was totally plausible or totally stupid.

Happy saving!

About the author

Peter Derk lives, writes, and works in Colorado. Buy him a drink and he'll talk books all day. Buy him two and he'll be happy to tell you about the horrors of being responsible for a public restroom.